Sensational Info About How To Sell Call Options

Call put option:

How to sell call options. Selling a call simply refers to selling the right, but not the obligation, to purchase shares of an underlying stock at a set price by a specified expiration date. The strategy of selling uncovered puts, more commonly known as naked puts, involves selling puts on a security that is not being shorted at the same time. It is the opposite strategy of buying a.

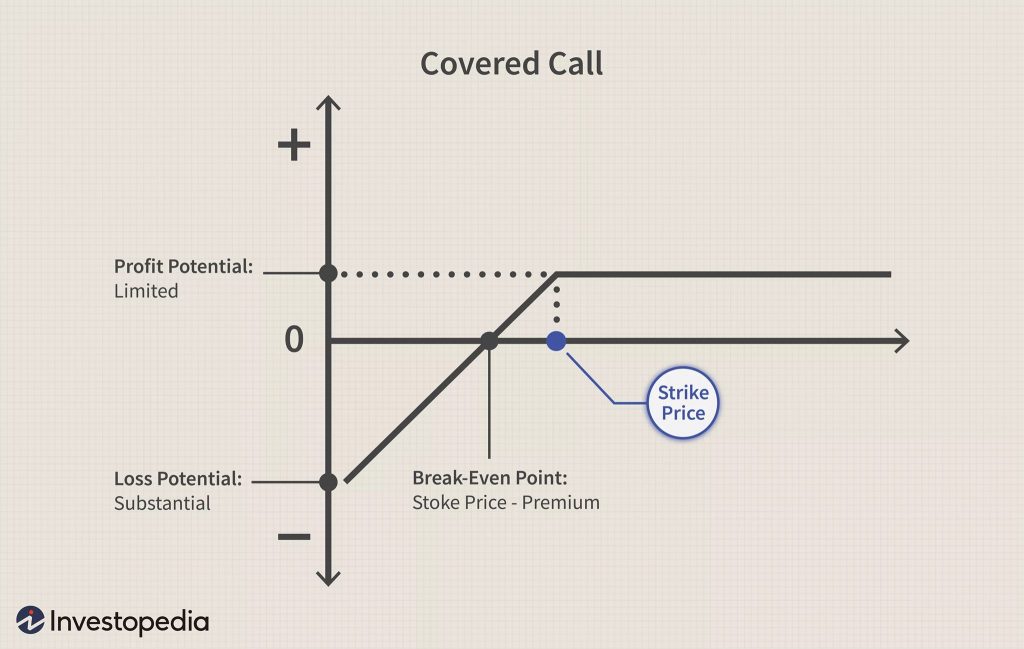

Speculation call options allow their holders to potentially gain profits from a price rise in an underlying stock while paying only a fraction of the cost of buying actual stock. 1) the covered call if the call option seller owns the underlying stock, the call option is covered. Strategy & education a beginner’s guide to call buying by alan farley updated april 22, 2022 reviewed by samantha silberstein fact checked by vikki.

There’s more room for haggling. You sell a call option with a strike. The primary distinction between them is the right that the ' call put option' grants the contract holder.

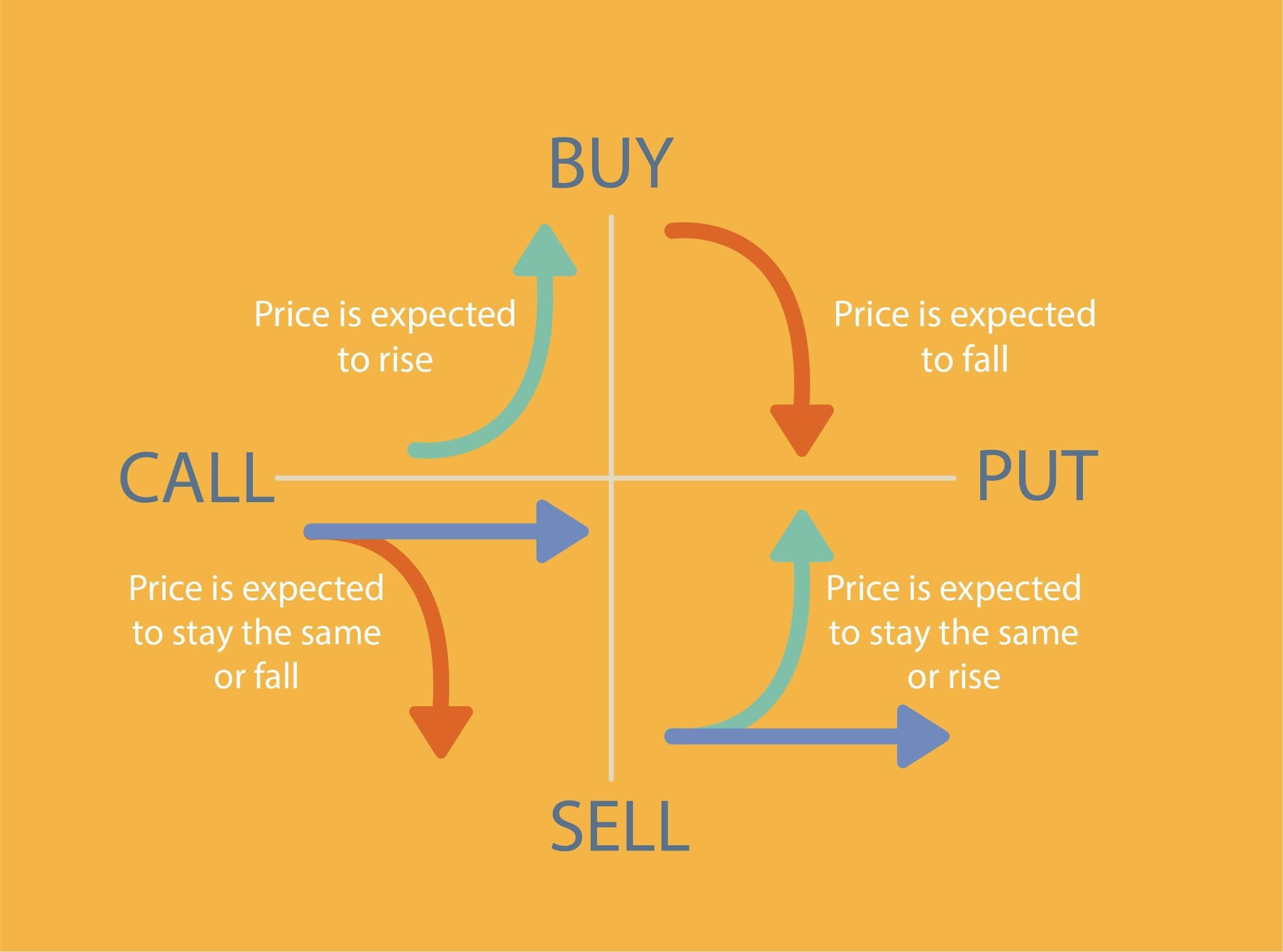

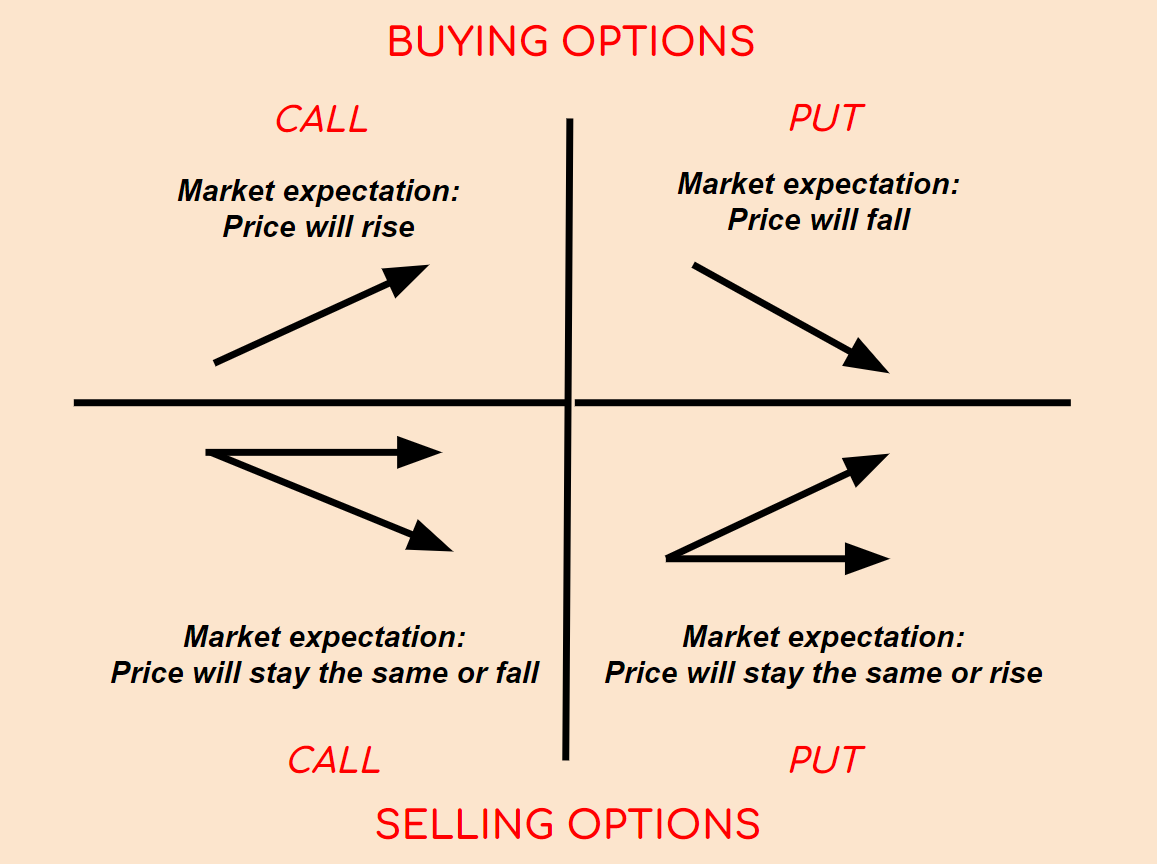

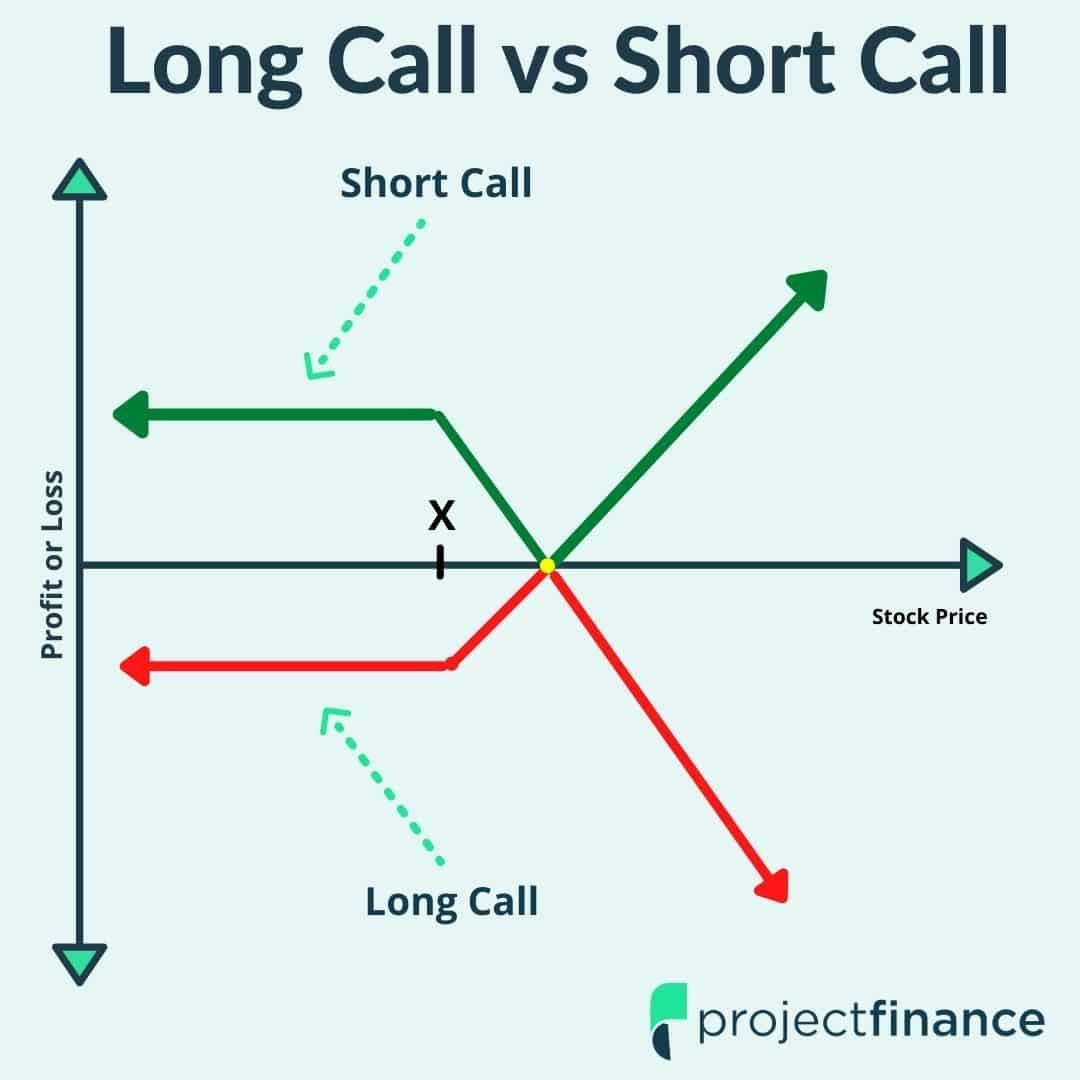

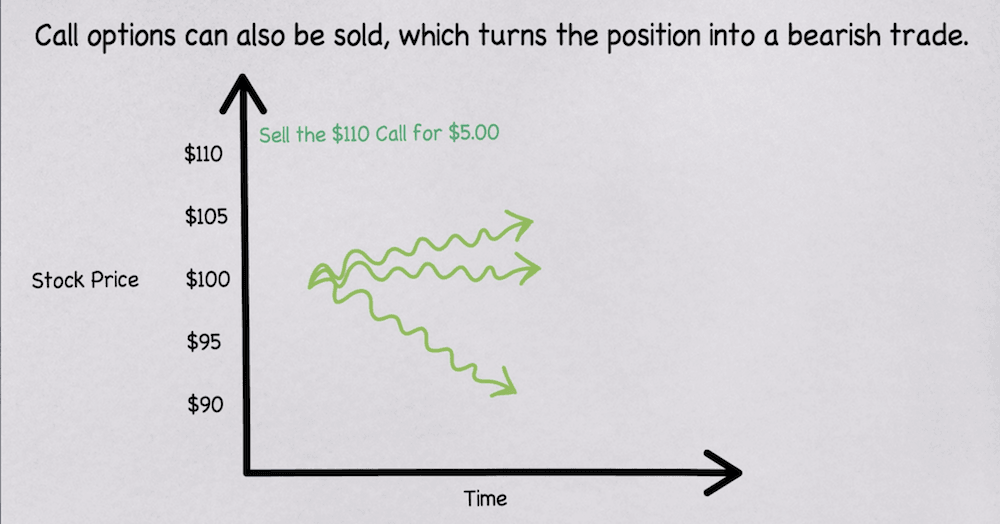

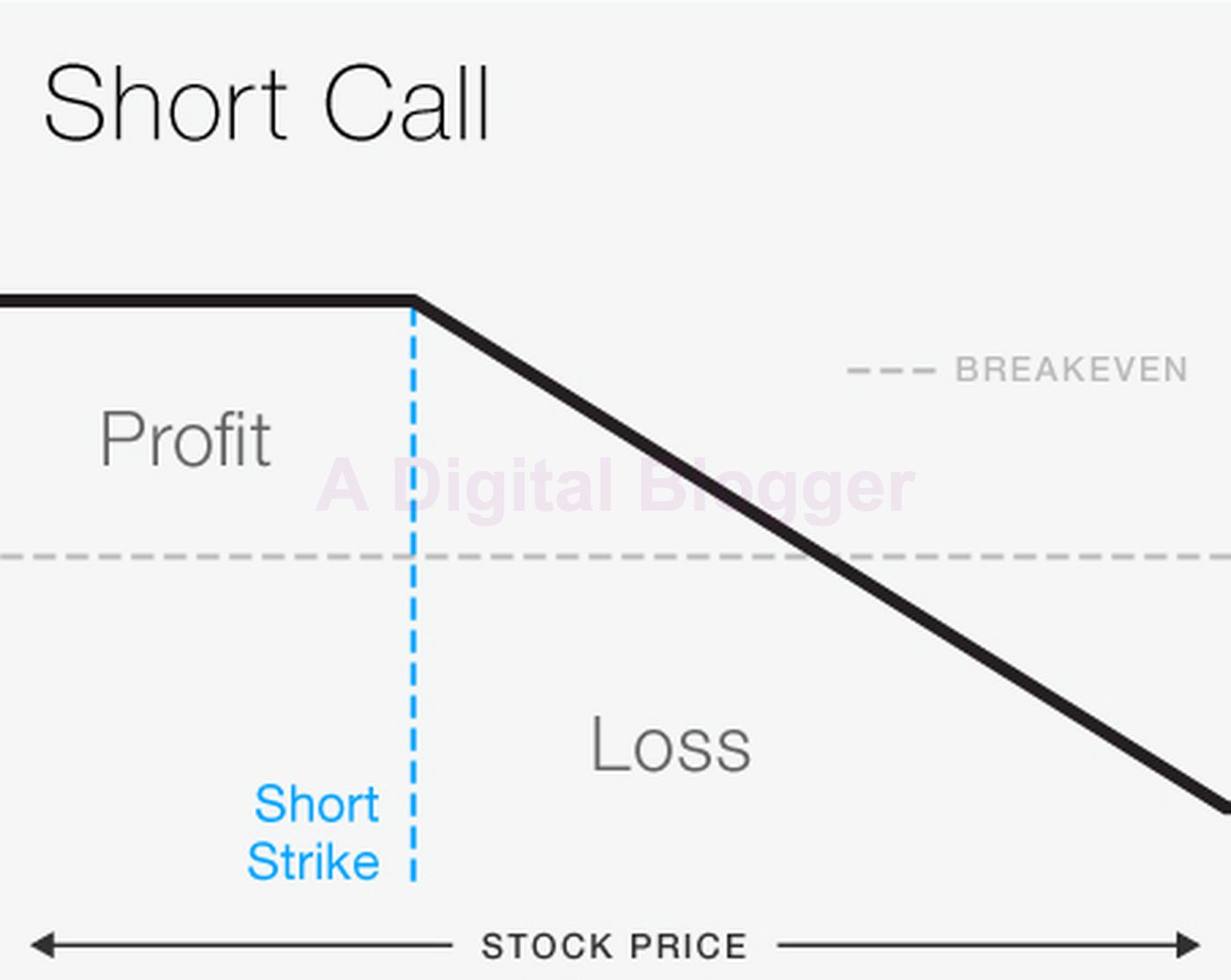

Right to buy or sell. The call option will likely be assigned, meaning you’re obligated to sell the underlying stock to the call buyer at the contract’s strike price. When you sell a call option, you’re bearish.

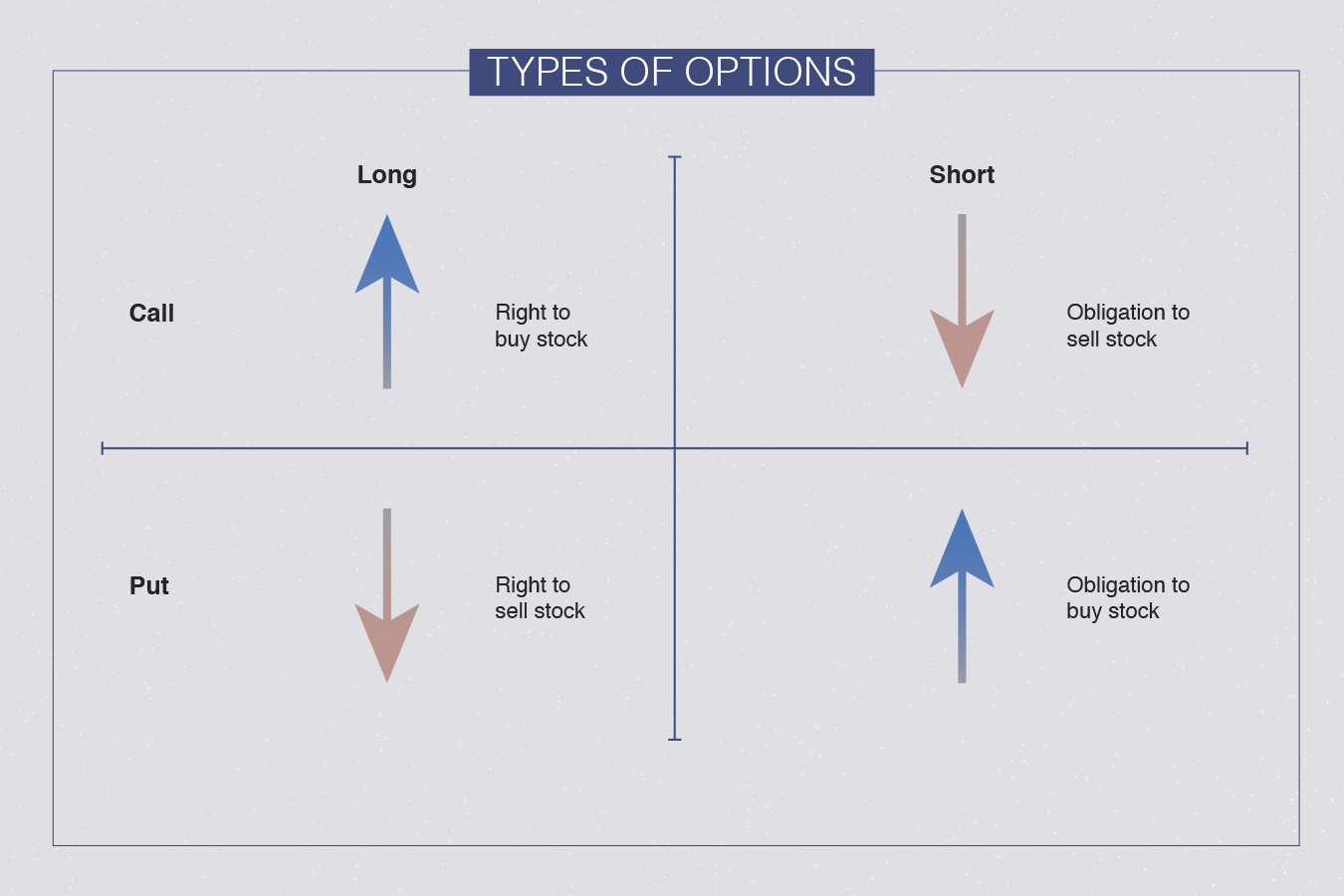

Buying call options is a. Buying a call option, selling a call option, buying a put option, and selling a put option. Options are a type of financial instrument known as a derivative because their value is.

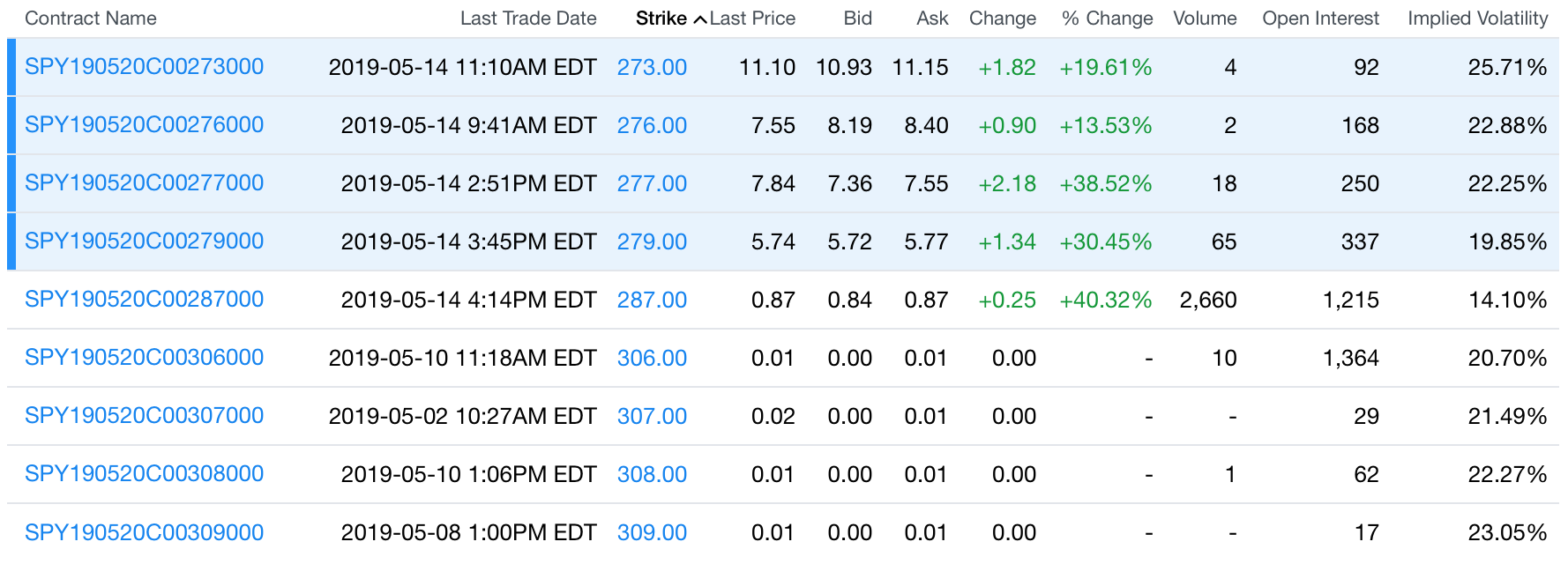

You determine the price at which you’d be willing to sell your stock. Shortly before the call options expire, suppose xyz is trading at $103 and the calls are trading at $8, at which point the investor sells the calls. The goal is for the options to expire worthless.

Call options can be purchased in two ways: Selling call options on these. A call option is essentially a type of derivatives contract that gives the option buyer the right, but not the obligation, to buy that asset at a specific price (known as the strike.

You own shares of a stock (or etf) that you would be willing to sell. When trading options, the buyer. You sell the call short and want it to drop in value.

On the other hand, the seller has an obligation to provide the stock if the buyer chooses to exercise the option. The intent of selling puts is the same as that of selling calls; Speaking on the nifty call put options data, chinmay barve, head of technical and derivative research at profitmart securities.

You keep the premium (money). You can get started trading options by opening an account, choosing to buy or sell puts or calls, and choosing an appropriate strike price and timeframe. Nifty call put option data.

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)