Top Notch Info About How To Resolve Debt

The type of debts you have.

How to resolve debt. Debt relief is a restructuring of debt to make it easier for you to pay it back. Assess how serious your situation is. If you have some money to pay your.

Before you say anything or make any payments, follow these steps: How much money you can pay towards your debts. 3 steps for dealing with a debt collector.

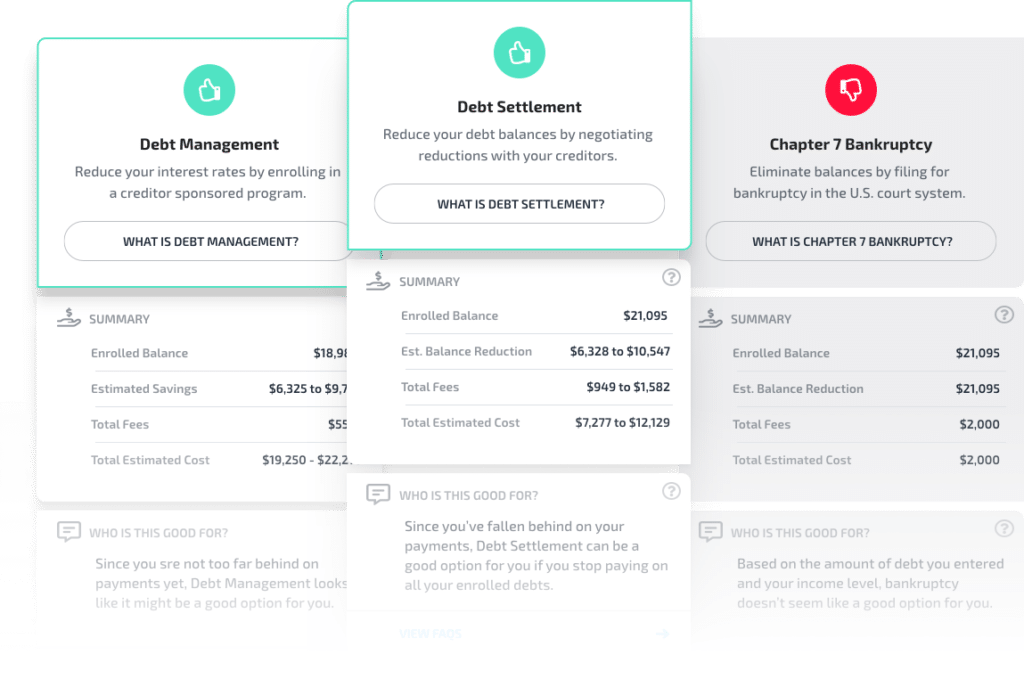

5 options for resolving debt. This includes correcting mistakes like a. Depending on your situation, bankruptcy may not be the best way to get rid of debt.

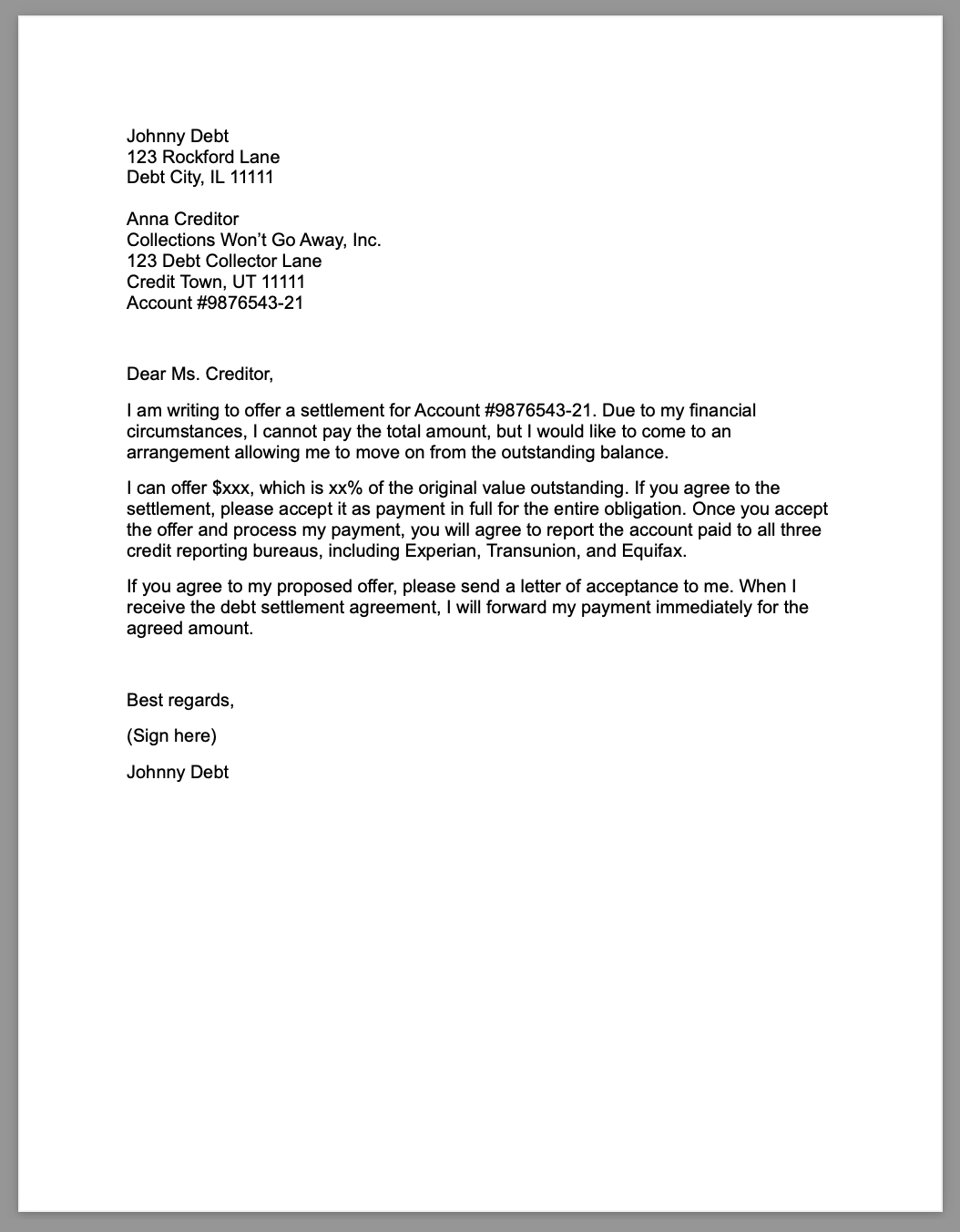

Negotiating a debt settlement on your own is not easy, but it can save you time and. Learn what debt collection is, when and how your debt is sent to collections, and what you should do once it's in collections. Attack the smallest debt with a vengeance while making minimum payments on the rest of your debts.

If you’re experiencing financial hardship, it’s possible to negotiate with your creditors to clear your debt for less than the full amount you owe. An unparalleled track record of student debt cancellation. Other options exist for people who can’t or don’t wish to file.

Settlement lowers your debt. But don’t volunteer any information of your own. 5 ways to deal with debt collectors.

Guide to debt reduction: You can get debt relief from lenders, debt relief companies and credit. It’ll depend on things like:

Debt, put simply, is when you spend more than you earn. Debt settlement is when you work with a debt relief company to resolve your debts, potentially lowering your debt by as much as 20%. How to manage debt of any size.

Don't give in to pressure to pay on first contact. Updated on october 25, 2021. Debt resolution means working out an agreement with.

List all your debts from smallest to largest—regardless of interest rate. If you have unaffordable debt and are struggling with financial hardship, you may be able to negotiate with. Egypt has been in a similar crunch before when debt to foreign oil companies piled up after a 2011 uprising, hitting $6.3 billion at one point.