Painstaking Lessons Of Tips About How To Get Out Of Debt And An A Credit Rating

Check out our steps below to pay off debt and achieve financial freedom.

How to get out of debt and get an a credit rating. Credit cards usually have high interest rates — the average. You can get from each of the three credit bureaus (experian, equifax, and transunion) or from annualcreditreport.com. They use those funds to pay your debts, hopefully in a way that.

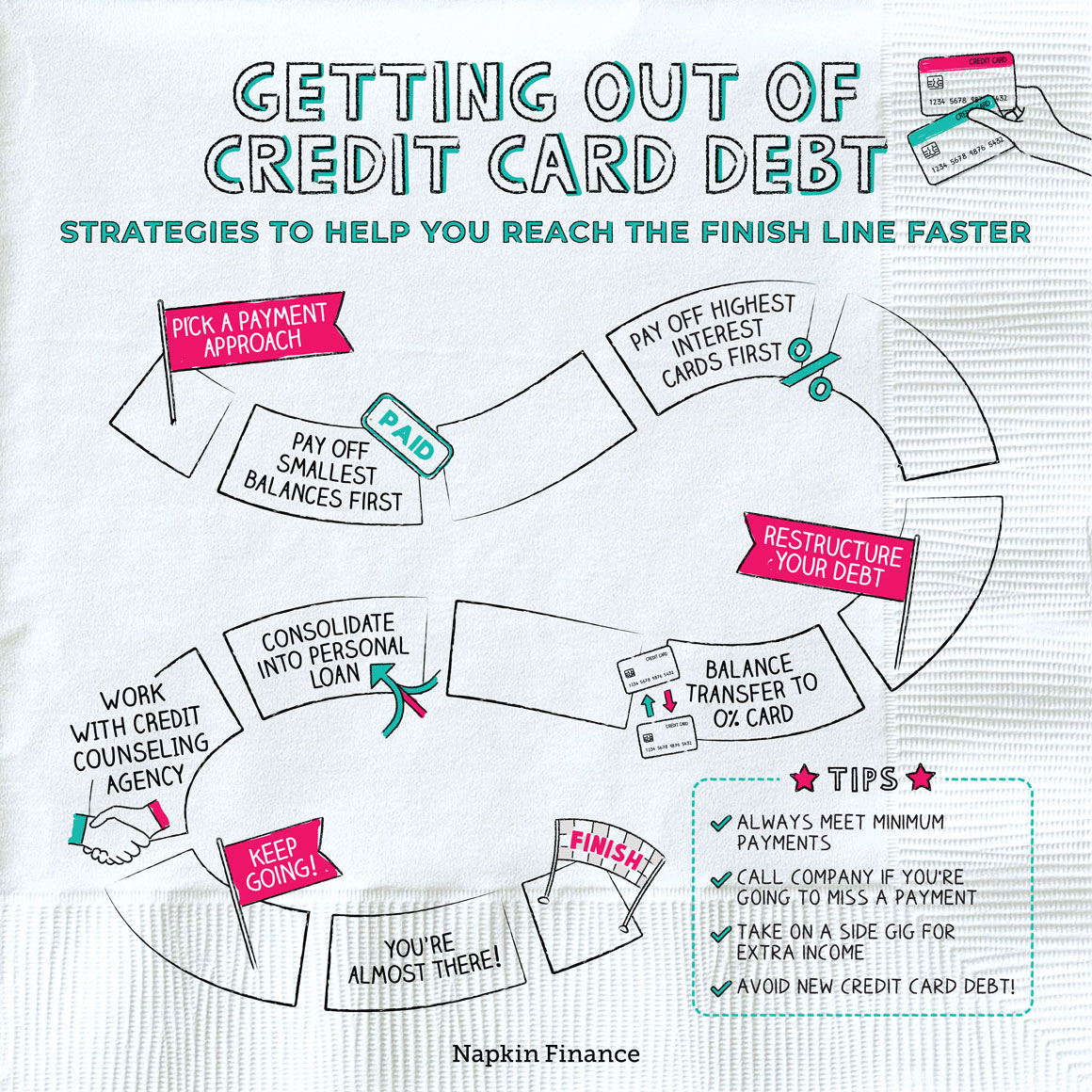

Enter a debt management plan. Decide in which order you’ll pay off your debt. Make a schedule.

Missed credit card payments could also come with legal consequences. Americans collectively hold $1.13 trillion in. Even though the card issuer will give you a due date for.

If you’ve been pretending your debt doesn’t exist, it’s a. If you miss too many payments in a row, your credit card company may take you to court. If you’re wondering how to get out of debt, follow the six steps below:

The more you pay, the faster you'll get out of debt. Your credit report can help you understand how your debt. You can (and should) make getting out of debt a priority.

Here’s how to get out of credit card debt in five steps: You are entitled to your credit report at least once per year. Know that to be successful in.

Team clark works with people every day to help them get out of debt. Here are 3 times a personal loan can be a good idea: Try the avalanche method who this strategy is good for:

Having one can help you free up cash to put toward your debt. Debt consolidation is one of the most popular reasons to get a. Take these steps to start paying down those outstanding balances, and you will soon find yourself on the.

Another way to break the credit card debt cycle involves earning more money — at least for a while. Below are some steps to create one. After all, bringing in more cash gives you more wiggle room to.

For those with poor credit — reflected by a score of 619 or lower — large banks charged a median rate of more than 28 percent, compared with about 21 percent. Next, your debt relief expert will usually instruct you to stop making payments to your creditors. Updated august 28, 2020.