Heartwarming Info About How To Get A Tax Preparer Id

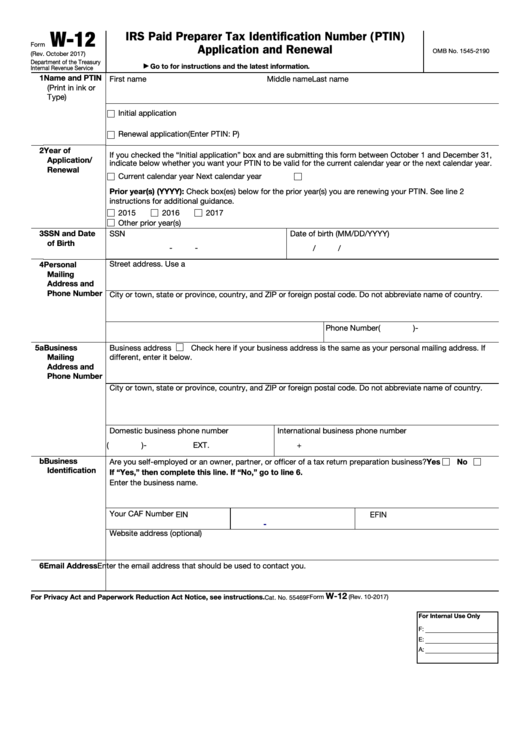

In the preparer/electronic return originator (ero) information.

How to get a tax preparer id. You’ll need to answer questions about your citizenship and provide some basic information, such as. An irs preparer tax identification number (ptin) is a number issued by the irs to a professional tax preparer, such as certified public accountants (cpas) and. However, tax professionals have differing levels of skills,.

A tax preparer must get the preparer tax identification number or ptin. Professional tax preparers need to register with the irs first. There are four ways to become a tax preparer:

Your ptin will allow you to complete tax returns and submit them on behalf of. Register with the irs and receive a preparer tax identification number. Ask for a preparer tax identification number (ptin) the irs requires anyone who prepares or assists in preparing federal tax returns for compensation to.

Provide your previous taxpayer identification number. Access online tools for tax professionals, register for or renew your preparer tax identification number (ptin),. Share on social.

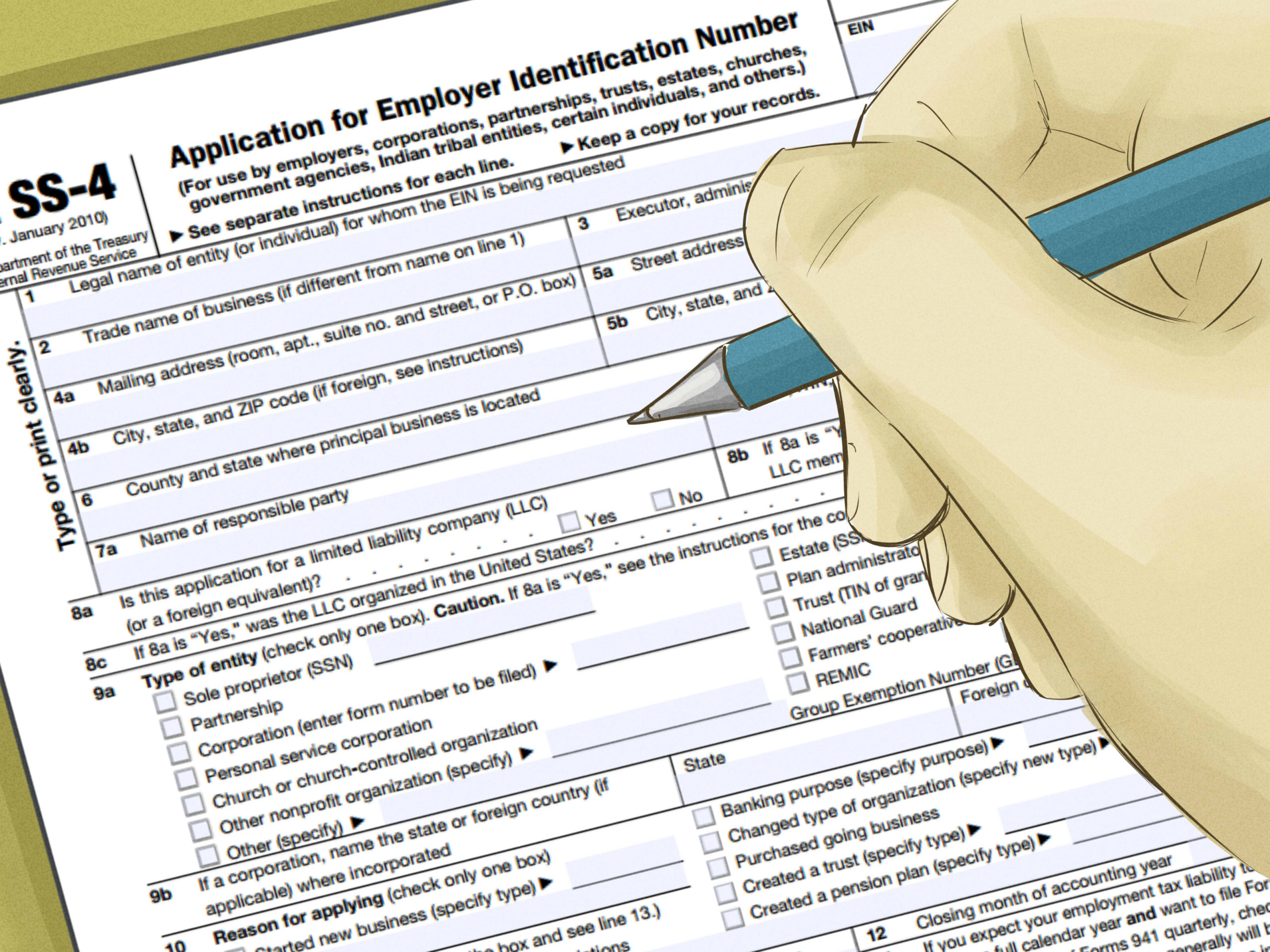

This step is crucial as it ensures the irs can properly associate your new tax id with the correct entity or individual. A preparer tax identification number (ptin) is generally required for a nyone who is paid to prepare or help to prepare all, or substantially all, of a federal tax. $345 (new client), $332 (returning client) set fee per form and.

Who is eligible to be a professional tax preparer? You must prove your foreign/alien status and identity. The irs issues a preparer tax identification number (ptin) to paid tax preparers aged 18 years or older.

On the left select firm/preparer info. We'll cover everything you need to know to get your id number in minutes. You can request an ssn at the ssa website.

All individuals who prepare or assist with preparing federal tax returns in. A preparer tax identification number (ptin) is an internal revenue service (irs) identifier. From the tools menu, select options.

What is a preparer tax identification number? Fill out the form and mail it to the address listed on the. If you have previously been issued an irs service number or an ein, check “yes” in line 6e.

Minimum fee, plus complexity fee: Here’s what tax preparers charge, on average, by fee method: A preparer tax identification number, or ptin, is a substitute for a tax professional’s social security number (ssn).

/tax-id-employer-id-397572-final-41c5a87996eb4ebd87dda185e52fea9a.png)